CCO Video Modifiers Made Easy:

FREE CCO TOOL:

www.cco.us

www.cco.us

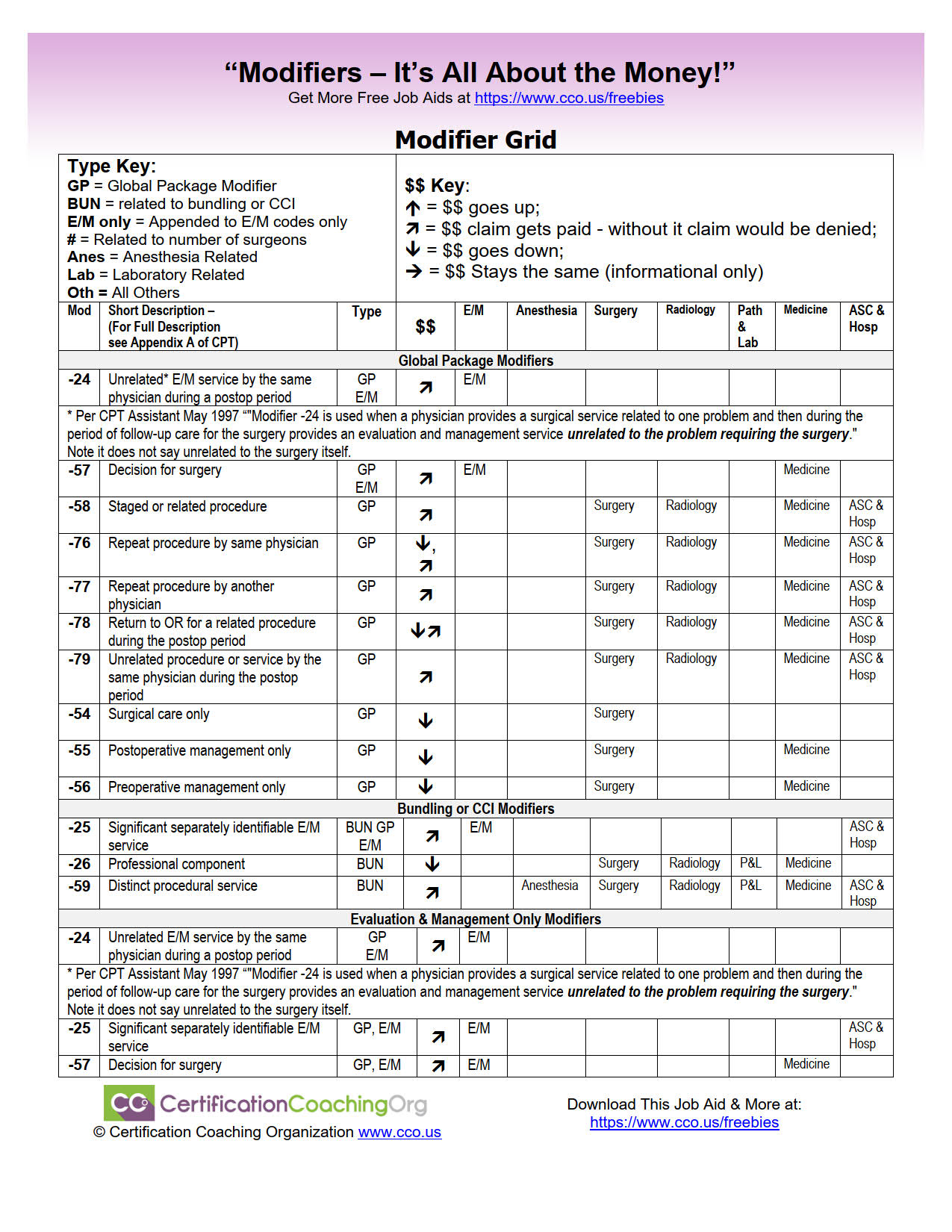

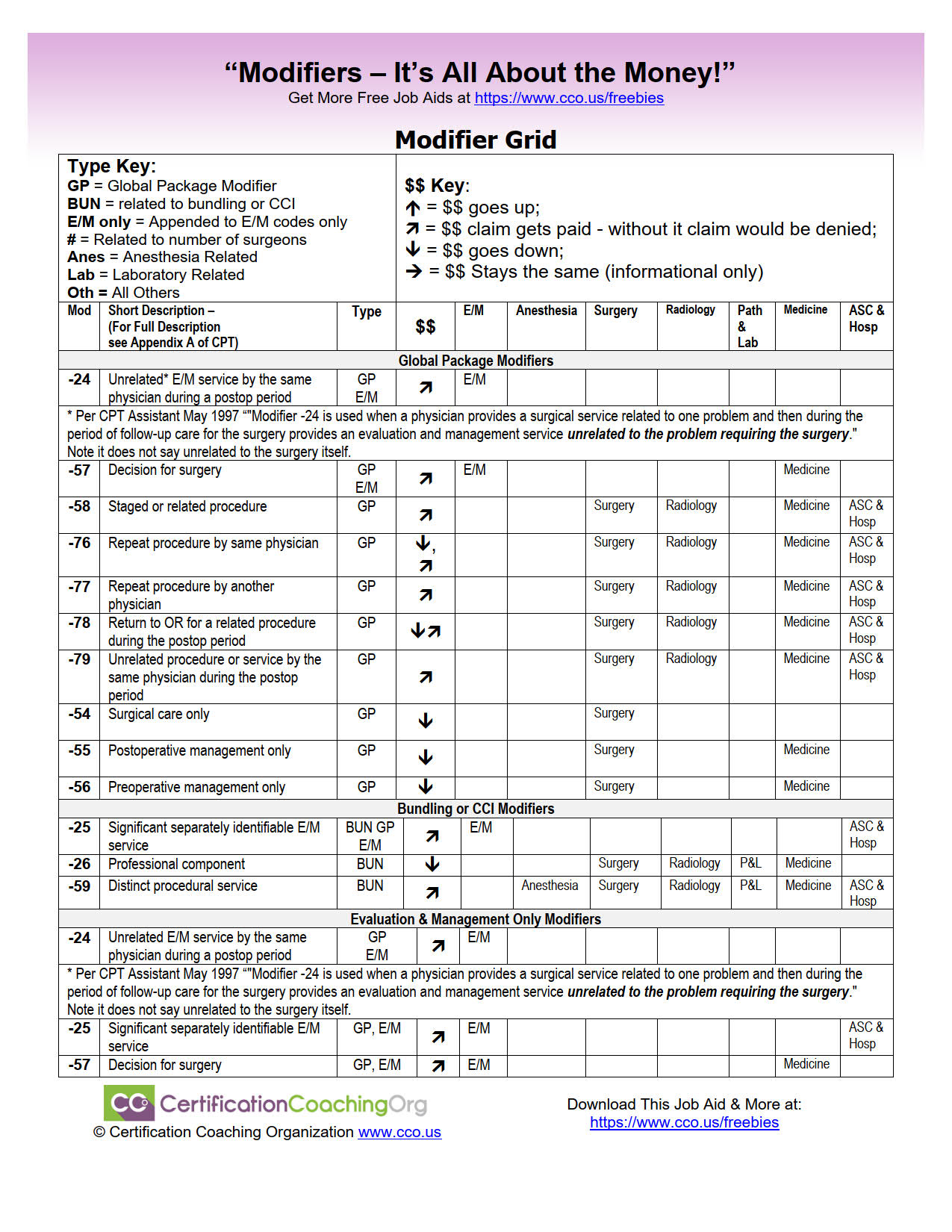

22- Increased Procedural Services

23- Unusual Anesthesia

24- Unrelated Evaluation and Management Service by the Same Physician or Other Qualified Health Care Professional During a Postoperative Period

25- Significant, Separately Identifiable Evaluation and Management Service by the Same Physician or Other Qualified Health Care Professional on the Same Day of the Procedure or Other Service

26- Professional Component

27-Multiple Outpatient Hospital E/M Encounters on the Same Date

32- Mandated Services

33- Preventative Services

47- Anesthesia by Surgeon

50- Bilateral Procedures

51- Multiple Procedures (some multiple surgical procedures must be reported WITHOUT modifier 51 identified as add on codes (appendix I)

52- Reduced Services

53- Discontinued Procedure

54- Surgical Care Only

55- Postoperative Management Only

56- Preoperative Management Only

57- Decision for Surgery

58- Staged or Related Procedure or Service by the Same Physician During the Postoperative Period

59- Distinct Procedural Service

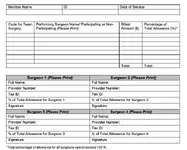

62 -Two Surgeons

63- Procedure Performed on Infants less than 4 kg.

66- Surgical Team

73- Discontinued Outpatient Hospital/Ambulatory Surgery Center (ASC) Procedure Prior to the Administration of Anesthesia

74- Discontinued Outpatient Hospital/Ambulatory Surgery Center (ASC) Procedure After the Administration of Anesthesia

76 -Repeat Procedure by Same Physician or Other Qualified Health Care Professional

77- Repeat Procedure by Another Physician or Other Qualified Health Care Professional

78- Unplanned Return to the Operating Room by Same Physician or Other Qualified Health Care Professional Following Initial Procedure for a Related Procedure During the Postoperative Period

79- Unrelated Procedure or Service by the Same Physician or Other Qualified Health Care Professional During the Postoperative Period

80- Assistant Surgeon

81- Minimum Assistant Surgeon

82- Assistant Surgeon (when qualified surgeon no available)

90- Reference (Outside) Laboratory

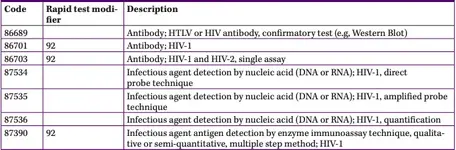

91- Repeat Clinical Diagnostic Laboratory Test

92-Alternative Laboratory Platform Testing

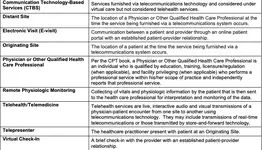

93 – Synchronous Telemedicine Service Rendered Via Telephone or Other Real-Time Interactive Audio-Only Telecommunications System

95- Synchronous Telemedicine Service Rendered Via a Real-Time Interactive Audio and Video Telecommunication System

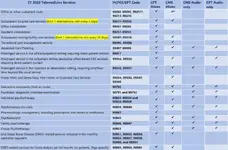

96-Habilitative Services

97-Rehabilitative Services

99- Multiple Modifiers

Review the proper use of each modifier.

Understand when each modifier should be applied.

FREE CCO TOOL:

CPT Modifier Decision Grid Tool

Free Job Aid: This CPT Modifier Decision Grid Tool will help you pick the correct CPT Modifiers at your medical coding job.

22- Increased Procedural Services

23- Unusual Anesthesia

24- Unrelated Evaluation and Management Service by the Same Physician or Other Qualified Health Care Professional During a Postoperative Period

25- Significant, Separately Identifiable Evaluation and Management Service by the Same Physician or Other Qualified Health Care Professional on the Same Day of the Procedure or Other Service

26- Professional Component

27-Multiple Outpatient Hospital E/M Encounters on the Same Date

32- Mandated Services

33- Preventative Services

47- Anesthesia by Surgeon

50- Bilateral Procedures

51- Multiple Procedures (some multiple surgical procedures must be reported WITHOUT modifier 51 identified as add on codes (appendix I)

52- Reduced Services

53- Discontinued Procedure

54- Surgical Care Only

55- Postoperative Management Only

56- Preoperative Management Only

57- Decision for Surgery

58- Staged or Related Procedure or Service by the Same Physician During the Postoperative Period

59- Distinct Procedural Service

62 -Two Surgeons

63- Procedure Performed on Infants less than 4 kg.

66- Surgical Team

73- Discontinued Outpatient Hospital/Ambulatory Surgery Center (ASC) Procedure Prior to the Administration of Anesthesia

74- Discontinued Outpatient Hospital/Ambulatory Surgery Center (ASC) Procedure After the Administration of Anesthesia

76 -Repeat Procedure by Same Physician or Other Qualified Health Care Professional

77- Repeat Procedure by Another Physician or Other Qualified Health Care Professional

78- Unplanned Return to the Operating Room by Same Physician or Other Qualified Health Care Professional Following Initial Procedure for a Related Procedure During the Postoperative Period

79- Unrelated Procedure or Service by the Same Physician or Other Qualified Health Care Professional During the Postoperative Period

80- Assistant Surgeon

81- Minimum Assistant Surgeon

82- Assistant Surgeon (when qualified surgeon no available)

90- Reference (Outside) Laboratory

91- Repeat Clinical Diagnostic Laboratory Test

92-Alternative Laboratory Platform Testing

93 – Synchronous Telemedicine Service Rendered Via Telephone or Other Real-Time Interactive Audio-Only Telecommunications System

95- Synchronous Telemedicine Service Rendered Via a Real-Time Interactive Audio and Video Telecommunication System

96-Habilitative Services

97-Rehabilitative Services

99- Multiple Modifiers

Review the proper use of each modifier.

Understand when each modifier should be applied.

- The procedure has both a professional and technical component

- Service is performed by more than 1 physician and/or in more than 1 location

- Service has been increased or reduced

- Only part of a service was performed

- An adjunctive service was performed

- Service or procedure was provided more than once

- Unusual events occurred

- Service was provided during a global period but is NOT included as part of the global reimbursement